Investing In Gold Coins.

What You Need To Know.

When investing in gold coins you need to decide which are the best type of Gold Coins for you.

Should you confine yourself to Bullion Coins which are defined by mass and purity of precious metal rather than by "face value" as money... or consider investing in gold coins that are rare and of numismatic value that collectors will pay a high premium for due to their scarcity and history?

Bullion Coins.

Bullion is defined as a highly refined, stamped, precise weight of precious metal (gold, silver, platinum).

Some investors prefer bullion purchased as ingot bars which come in many sizes... 1/2, 2, 2.5, 5, 10, 20 and 350-430 ounces... or 1, 2.5, 5, 10, 20, 50, 100 grams and a Kilo bar.

Many prefer to purchase bullion bars only from a recognized commercial custodian (like the Australian Perth Mint) to reduce the likelihood of tampering and fake bars.

Others however prefer investing in gold coins, especially "bullion gold coins" (which also range from 1/2 ounce up to 1 Kilo) thinking they provide easier portability and liquidity.

These coins should trade at close to intrinsic precious metal value with only a small premium added (3 to 5 percent). Investors should be aware that some so called "bullion coins" are sold at premiums of up to 70 percent.

South Africa first issued the one ounce (or 31.1035 grams) Krugerrand in 1967.

This 22-karat bullion coin was struck and sold at the current spot price of gold plus a small premium.

By 1980 the Krugerrand had captured 90% of the gold coin market.

Not surprisingly copycat gold coins soon followed... the Canadian Mapleleaf in 1979, the Australian Nugget in 1981, the American Eagle in 1986, the U.K. Britannia in 1987.

Currently there are over 54 million Krugerrands in circulation.Gold Fineness.

Fineness denotes the actual gold content of a coin, 1000 fine representing 100 percent pure gold.

A coin with a fineness of say 750.0 fine (i.e. 18 karat) contains 25 percent of some other alloy.

- 24 karat = 1000 fine

- 22 karat = 916.6 fine

- 18 karat = 750.0 fine

- 14 karat = 583.3 fine

Collector Coins.

The "Grade" or "sate" of a coin refers to the amount of wear and scratching on a scale of 0 to 70...Mint State/MS 70 being perfect.

- GOOD/G = Mint state 4 and 6 (designs, dates and legends visible but badly worn)

- VERY GOOD/VG = Mint state 8 and 10 (designs and date lacking detail, "full rim" on coin's edge visible)

- FINE/F = Mint state 12 and 15 (all major details visible and complete)

- VERY FINE/VF = Mint state 20, 25, 30,35 (better details visible and complete)

- EXTREMELY FINE/XF/EF = Mint state 40 and 50 (light wear high points, some mint luster)

- ALMOST UNCIRCULATED/AU = Mint state 50, 53, 55, 58 (slight wear high points, over half mint luster)

- UNCIRCULATED/UNC = Mint state 60 to 70 (no wear, small marks or nicks)

- PROOF/PF especially struck for collectors (mirror like surface)

Coin grading is often subjective and not always exact.

Some prominent grading organizations have appraisals carried out by up to three independant graders then seal the coin sonically in a protective, inert "slab".

This is done to reassure and protect investors against the many fakes and coin scams that exist.

The Most Valuable Coin On Earth?

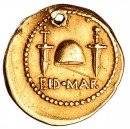

You're thinking most likely some rare antiquity like this Roman gold coin that was probably dug up in distant, dusty ancient ruins somewhere.

Well you'd be wrong.

The most valuable gold coin on Earth currently is a 1933 Gold Double Eagle, designed by American sculptor Augustus St. Gaudens.

In 1933, in the depths of the Great Depression, President Roosevelt took America off the "Gold Standard" by issuing Executive Order 6102.

This forbad Americans from "the Hoarding of Gold Coin, Gold Bullion, and Gold Certificates"

U.S. Gold Double Eagles had previously been issued from 1907 to 1932, and the U.S. Mint had 445,500 new coins awaiting issue in 1933.

Following Executive Order 6102 two 1933 Double Eagles were handed over to U.S National Mumismatic Collection at the Smithsonian Institute. The rest were ordered to be destroyed. It was later discovered that a Mint worker smuggled out about 20 of the doomed coins and most probably sold them to a local jeweller, Israel Switt.

Over past decades Secret Service agents eventually ended up tracking down and seizing 9 of these coins. It was one of these that was sold at auction by the Mint (after a lawsuit by its owner) in July 2002 and the proceeds split.

The coin was sold for the record price of $7,590,000 including the buyer's 15% commission.

In 2004 ten more of these coins surfaced (in the possession of one of Israel Switt's heirs) and were subsequently seized by U.S. officials and are currently under legal dispute.

Coin collectors around the world wonder how the sudden release of 10 additional Double Eagles will impact on the price of the most valuable gold coin in the world.

Beware of Counterfeit Fakes when Investing in Gold Coins.

Uploaded on 29 Jun 2011.

GOLD COINS: Buying, Grading, Collecting and Enjoying Them. Investing In Gold Coins...HOW TO START.

A 52 year old man was robbed of the bulk of his life savings in Chilliwack B.C. 100 km east of Vancouver. Two robbers, dressed as policeman, gained entry to his home and attacked him. They then forced him to open a 1mx1m safe containing the bullion and stole silver bars valued at $750,000.

The man had the silver stashed at home because his bank had refused to store it. It was uninsured because the cost would have been "astronomical".

The victim blamed "some friend..or friend of a family member" who "leaked it to the wrong people". Police warned that "people should think twice before storing valuables and cash at home".

Security is absolutely vital if storing valuable bullion bars or coin collections at home.

When investing in gold coins or bullion a bank safety deposit box may be a wise consideration. If you do decide to install a discrete, secure safe in your home, total discretion must be maintained with friends, family and acquaintances to minimize the risk of burglary or robbery.

Who Ate My Lunch?

by Eugene Roberts

The Internet Revolution, Globalization, and the Global Financial Crisis created the perfect storm... Old Business models are being destroyed and jobs are disappearing offshore at an astonishing rate. Analysts warn that "China and India are poised to out-think us and out-compete us by their sheer numbers" and that "there is no job security now".

Read more of

Who Ate My Lunch?

for free.