Real Estate Investing FAQ.

The following Real Estate Investing FAQ (frequently asked questions) will hopefully give you food for thought and help get you pointed in the right direction.

Investing in property can make you a lot of money and provide security.

But always do your due diligence and seek out professional advice first. And don't forget what "the world's smartest investor - Warren Buffett" had to say about real estate and borrowing too much money to leverage your investment;

"A house can be a nightmare if the buyer's eyes are bigger than his wallet. Our country's social goal should be not to put families into the house of their dreams... but rather to put them into a house they can afford."

"Some people have become very rich through the use of borrowed money. However, that's also been a way to get very poor."

"History tells us that leverage all too often produces zeros, even when it is employed by very smart people."

Real Estate Investing FAQ No 1.

Is Real Estate A Better Investment Than Shares?

These two asset classes are as different as chalk and cheese.

Shares are much more volatile than real estate.

Shares can "go up the stairs and come down in the elevator" in dramatic fashion. They can sometimes see 90% of their value suddenly wiped out like General Motors shares in this chart.

Real estate prices don't generally fluctuate up and down as wildly as stocks; and because everybody has to have a home to live in banks are willing to make much larger loans on property (allowing you to use more leverage).

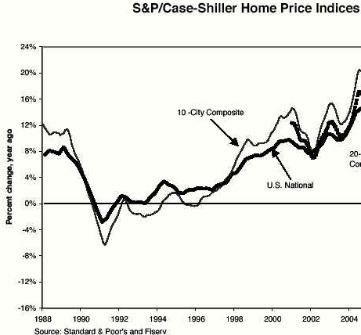

Generally real estate prices increase in value in a gradual, sustainable way like this...

... depending on demographic and population changes, the economic climate, interest rates levels, low unemployment levels,

immigration intake, etc.

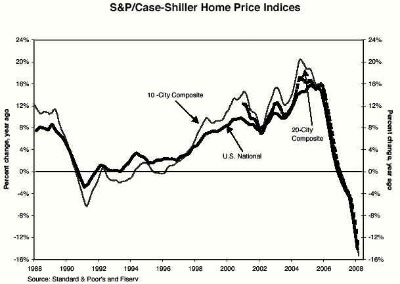

But every once in a while real estate investors too get carried away with "irrational exuberance". That's when we end up with a property bubble followed by a property crash, which looks like this...

Real Estate Investing FAQ No 2.

When Is The Best Time To Buy Real Estate?

A simple answer might be DON'T BUY REAL ESTATE WHEN IT'S OVERPRICED.

The reality is it's not always easy to establish what a property's worth, how its value will rise or fall in the future (depending on where we are in the property cycle), or whether an apparently high price is justified due to re-development potential.

If you're in the middle of a real estate "bubble" it is almost impossible to remain objective and not get swept up in all the hysteria. You just have to do your due diligence, seek advice from unbiased professional advisors, and be prepared to hold onto your property long term (to cover the substantial costs involved in buying and selling and to ride out any downturns).

Real Estate Investing FAQ No 3.

What Types Of Real Estate Investment Are Available?

- Residential... houses, apartments, duplexes... generally safest, usually returning around 5% gross plus any capital gain.

- Commercial... factories, shops, offices... usually provides higher returns around 7-10% with tenants paying out-goings... often much more expensive, banks more choosy about lending.

- REITs... are equities in companies owning a diversified portfolio of commercial properties... act more like shares (with associated risks) than real estate... allow investment of small amounts with low costs and no maintenance.

Real Estate Investing FAQ No 4.

Where Should I Buy Property?

The Global Financial Crisis of 2007-2008 caused real estate markets in some countries like Ireland and the U.S.A to teeter and crash. This prompted investors in regions not yet punished to try and cash in on slumping property prices.

TV news broadcasts showed investors from all around the globe flocking to Las Vegas, Florida and California to join "Foreclosure Bus Tours" in a frenzied search to pick up foreclosure bargains.

However, many investors feel more comfortable researching and investing in their local market. Their knowledge of what property has been selling for and the development potential of the area can help them recognize future hot spots and decide when is the right time to buy, and which is the best location.

Buying locally also makes it easier to manage and keep an eye on your investment property.

Real Estate Investing FAQ No 5.

What Are The Negatives Of Investing In Real Estate?

- REITs act like shares. Many crashed or were frozen in the GFC.

- Buying and selling costs mean property is often better held over the medium to long term (say 5 years or more). It's often not easy to "flip" a property.

- Real Estate is not as liquid as cash or shares if an emergency arises.

- Real estate usually involves paying for maintenance, taxes, utilities, management fees, insurance, dealing with bad tenants, etc.

- Property values can fall and take some time to recover.

- Too much leverage can be risky in a falling market.

Real Estate Investing FAQ No 6.

How Much Money Do I Need?

The days are long gone when you could buy real estate with "no money down" and "no doc loans".

Today's lenders want to see you stump up a 10-20% deposit of your own money. For a commercial loan you'll probably need an even bigger deposit and be able to convince nervous lenders that your figures stack up and your tenant is rock solid.

Real Estate Investing FAQ No 7.

How Do Interest Rates Impact On Real Estate?

Rising interest rates can crucify an investor who is highly leveraged.

There are times you can take advantage of "easy money" and variable-low-interest rate loans, but there are also times you need to lock in longer term fixed rates so you can manage your risk and sleep at night.

Property Bubble in China?... Dateline, SBS Jan 2012.

Who Ate My Lunch?

by Eugene Roberts

The Internet Revolution, Globalization, and the Global Financial Crisis created the perfect storm... Old Business models are being destroyed and jobs are disappearing offshore at an astonishing rate. Analysts warn that "China and India are poised to out-think us and out-compete us by their sheer numbers" and that "there is no job security now".

Read more of

Who Ate My Lunch?

for free.